Analysis of Energy Storage Revenue Paths under the Guidance of Document No. 136

Classification:Industrial News

- Author:ZH Energy

- Release time:Jun-18-2025

【 Summary 】Since May, various regions have been issuing provincial implementation documents for Document No. 136. The confirmation of revenue sources for energy storage will lead to a new wave of construction trends in energy storage development.

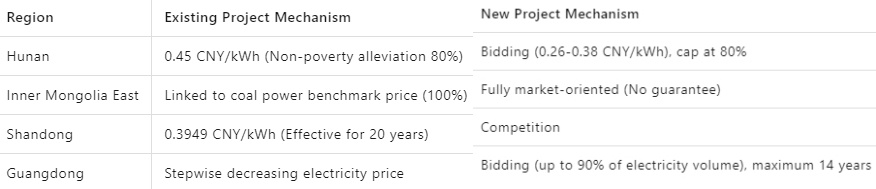

Since May, various regions have been issuing provincial implementation documents for the national Document No. 136. Recently, the Inner Mongolia East region has officially released the formal document titled "Implementation Details of the Inner Mongolia East No. 136 Document: The mechanism electricity price for existing projects is set at the coal-fired benchmark price, and new projects will not be allocated mechanism electricity for the time being." Shandong and Guangdong have issued draft opinions for public comment, titled "Shandong: The first provincial implementation details after Document No. 136, with a mechanism electricity price of 0.3949 yuan per kWh for projects put into operation before May 31," and "Guangdong Implementation Details for Document No. 136: Mechanism electricity volume ≤ 90%, and the mechanism electricity price can be implemented for up to 14 years." Although there are distinct local characteristics in the specific mechanism design, a core trend is revealed: Under the increasingly refined and differentiated electricity price mechanism framework, the key infrastructure for supporting projects to actively generate profits is shifting towards a clear and diversified market-oriented profit path.

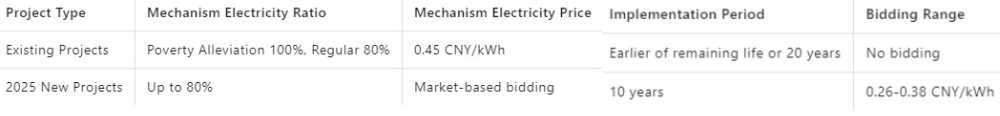

Recently, the Hunan Provincial Development and Reform Commission released the "Notice on the Implementation of the Interim Detailed Rules for the Deepening of New Energy Grid-connected Electricity Price Market-oriented Reform." The core breakthrough of Hunan's implementation details is the establishment of a dual-track system for new energy electricity prices, clearly distinguishing between existing and new projects.

Existing projects are granted transitional protection: The electricity corresponding to the poverty alleviation capacity of photovoltaic poverty alleviation projects will be fully included in the mechanism electricity volume. Conventional distributed photovoltaic projects, wind power projects below 35 kV, and centralized photovoltaic projects will be included at 80% of their grid-connected electricity volume. All existing projects will uniformly implement a mechanism electricity price of 0.45 yuan per kWh, with the implementation period determined by the earlier of the remaining full life cycle reasonable utilization hours of the project and the year when the project has been in operation for 20 years.

New projects face market competition directly: In the newly added wind power and photovoltaic projects in 2025, only 20% of the grid-connected electricity volume can be included in the mechanism scope through bidding. The declaration proportion for a single project shall not exceed 80%, with a bidding upper limit of 0.38 yuan per kWh and a lower limit of 0.26 yuan per kWh in 2025. These limits will be dynamically adjusted according to the actual situation after 2026, and the implementation period of the mechanism electricity price after bidding will be fixed at 10 years.

Previously, in the handling of the mechanism for existing projects, Shandong and Guangdong both clearly provided relatively fixed mechanism electricity price guarantees for projects connected to the grid before specific time points (0.3949 yuan per kWh for Shandong and a stepwise decreasing electricity price for Guangdong), while Inner Mongolia East chose to directly link existing projects to the local coal-fired benchmark price. For new projects, a competitive mechanism has become the mainstream: Guangdong requires the determination of mechanism electricity volume and price through bidding, Shandong forms it through competition (without a clear upper limit), and Inner Mongolia East directly does not arrange mechanism electricity volume for new projects, forcing new projects to operate entirely in a market-oriented manner. The implementation period of the mechanism also varies significantly: Shandong's existing projects cover a long period of up to 20 years, Guangdong proposes a maximum of 14 years (including the construction period), and Inner Mongolia East does not specify the period for existing projects. In terms of mechanism electricity volume proportion, Guangdong sets an upper limit of no more than 90%; Shandong does not specify a proportion; Inner Mongolia East's existing projects are fully included due to the implementation of the coal-fired benchmark price, and there is no concept of proportion for new projects. These differences reflect the different considerations of each province in balancing new energy development, system absorption capacity, and user electricity price affordability.

As more provincial details are implemented, the competition in the new energy sector is shifting from resource grabbing to a competition of "flexible asset allocation." From Hunan's monthly adjustment mechanism, Inner Mongolia East's full market-oriented approach, Shandong's long-term fixed electricity price, and Guangdong's stepwise decreasing design, it is expected to promote the transition of new energy electricity prices from subsidy-driven to market-driven, establish a sustainable price settlement mechanism, ensure reasonable returns for existing projects, stimulate market vitality, and promote high-quality development of new energy. This will further optimize the allocation of energy storage resources, avoid blind investment and oversupply caused by policy orientation, and enable the energy storage industry to enter a new stage of high-quality development based on its own value, becoming an indispensable part of the new power system.

Product Series:

Flow Battery Test Platform