Gansu’s Dual New-Energy Pricing Reforms: Igniting Long-Duration Storage

Classification:Industrial News

- Author:ZH Energy

- Release time:Jul-18-2025

【 Summary 】Gansu Power-Price Reform Breaks New Ground: A Market-First “Test Run”! A Clear Windfall for 6-Hour-Plus Long-Duration Storage

On 14 July, the Gansu Provincial Development and Reform Commission simultaneously released two landmark consultation papers: the “Implementation Plan for Deepening Market-oriented Reform of New-energy On-grid Tariffs to Foster High-quality New-energy Development in Gansu Province (Exposure Draft)” and the “Notice on Establishing a Generation-side Capacity Tariff Mechanism in Gansu Province (Exposure Draft)”.

The first paper charts a path toward full market pricing for new energy. By introducing an innovative “differentiated tariff + capacity compensation” design, it opens an unprecedented value-realisation channel for the energy-storage sector and marks the first time a Chinese province has fully transitioned its new-energy pricing system to a market mechanism.

All centralized and distributed solar PV, wind and solar-thermal projects will, in principle, sell their entire output through the electricity market; prices will be formed through market transactions rather than government benchmarks. For both legacy and new projects, differentiated rules explicitly reward the system-regulation value of storage.

Even more groundbreaking is the companion capacity-tariff mechanism. For the first time at provincial level, grid-side new-type storage is formally included in a capacity-payment scheme. The capacity tariff is set at an upper limit of RMB 330 /kW-year and is guaranteed for two years, making Gansu the most advanced provincial test bed—after the national call—for precisely rewarding long-duration flexibility.

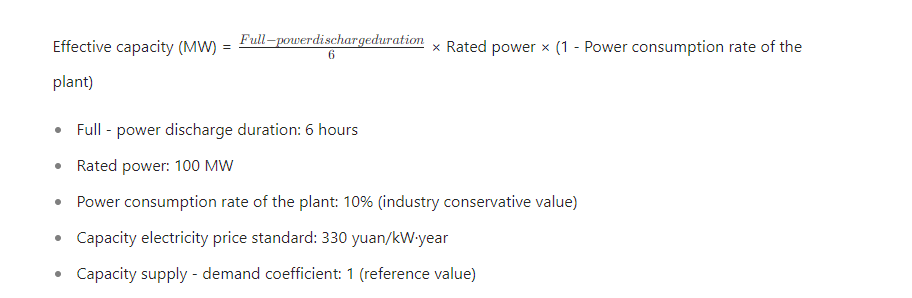

Beyond the higher cap, the rules define effective capacity for grid-side new-type storage as (rated power × full-power discharge duration / 6) – auxiliary consumption. Projects with ≥6 h duration therefore gain a clear advantage in qualifying for capacity payments, directly addressing the new power system’s need for long-term adequacy and operational flexibility. This creates an unambiguous revenue outlook for long-duration technologies.

Within this policy framework, vanadium-flow batteries align almost perfectly with the regulatory intent and are poised for a major breakthrough. A 100 MW / 600 MWh (6-hour) vanadium-flow plant could earn capacity payments of nearly RMB 30 million per year when the capacity-supply coefficient equals 1, materially improving project economics. Stacked on top are spot-market arbitrage (with a clearing-price cap of RMB 1 /kWh) and ancillary-service revenues, yielding a diversified and sustainable business model.

The documents explicitly encourage technological diversity, endorsing mainstream chemistries such as lithium-ion, sodium-ion and all-vanadium flow batteries, while also promoting demonstration projects for high-temperature molten-salt and compressed-air storage. This orientation dovetails with Gansu’s strategy of building a “western China new-materials hub.” In provinces rich in wind and solar resources but facing curtailment risk, ≥6-hour storage bridges the midday solar peak and the nighttime wind surplus, smooths output curves and markedly raises renewable utilisation. As these policy dividends continue to unfold, 6-hour-plus long-duration storage will play an ever more critical role in renewable integration, peak shaving and system stability, emerging as one of the most dynamic growth points in China’s new power-system transformation.

Product Series: