Analysis of 45MW/225MWh Energy Storage Project in High-Safety Scenarios: Safety and Economic Viability

Classification:Industrial News

- Author:ZH Energy

- Release time:Jun-13-2025

【 Summary 】ZH Energy NeLCOS Energy Storage Cost Calculator, calculating the return on investment of your energy storage system for free.

As a core integrated refining and petrochemical enterprise and an important energy base in South China, the Guangzhou Petrochemical Group has an annual crude oil processing capacity of 12.75 million tons, extensive continuous production facilities, and its own power station. Given the extremely high power stability requirements for its production processes and the significant peak-valley electricity price differential in Guangdong, the group plans to install a 45MW/225MWh vanadium redox flow battery energy storage system to implement a green and low-carbon strategy, achieve cost reduction and efficiency improvement, and ensure the inherent safety of the energy storage system.

The vanadium redox flow battery uses a water-based, non-flammable electrolyte, which completely eliminates the risk of thermal runaway, combustion, and explosion. Its intrinsic safety characteristics provide absolute security assurance for high-risk, high-safety-level sites like chemical parks, perfectly meeting the core safety requirements of chemical enterprises for energy storage systems.

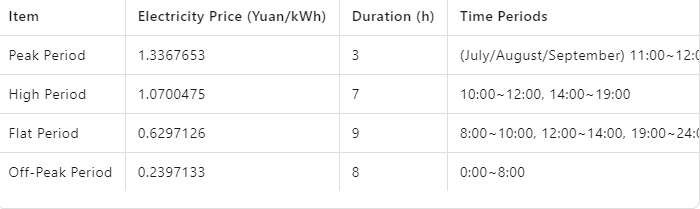

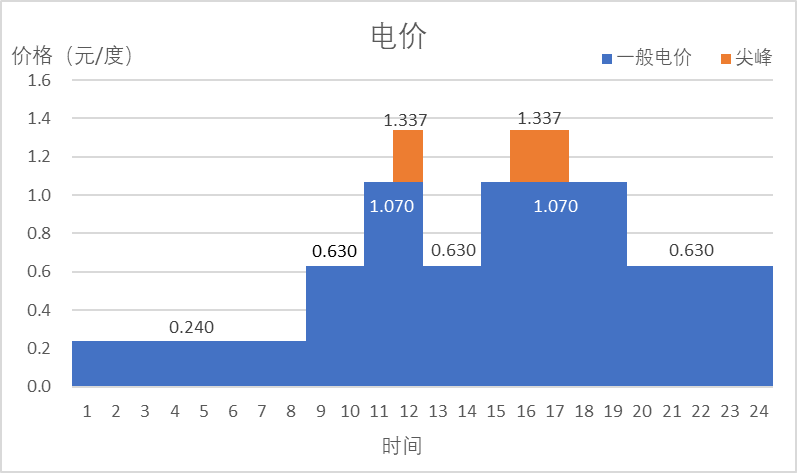

From December 2022 to October 2023, the average electricity prices for the petchemicalro group are as follows:

According to the electricity consumption analysis, the peak period lasts for a total of 7 hours, divided into two time slots: 2 hours in the morning and 5 hours in the afternoon. There are 2 hours of flat-rate periods before each peak period, and 5 hours of flat-rate periods after the afternoon peak period. The off-peak period lasts for 8 hours overnight. Given that the efficiency of the energy storage system is 70%, the charging time during the off-peak period is 8 × 70% = 5.6 hours. The system is fully charged during the off-peak period and discharges for 2 hours from 10:00 to 12:00 and for 3 hours from 15:00 to 18:00 during the peak periods, resulting in a total of 1.0 charge-discharge cycle per day.

The investment structure consists of 30% equity from the investors and the remaining 70% financed through loans. The loans are repaid in equal monthly installments over 20 years at an annual interest rate of 3.5%. In the cost calculation, the civil construction cost is calculated as 1% of the equipment cost. The value-added tax (VAT) rate for equipment is 13%, and for civil construction, it is 9%. The income tax rate is 25%. The annual operation and maintenance cost is calculated as 1% of the equipment cost. The energy storage system's capacity degrades to 90% of its initial capacity over 20 years. At the end of the 20-year life, the recovery rate of the vanadium redox flow battery electrolyte can reach 60%, and the recovered funds are counted as income in the final year.

Based on the above operational analysis, the economic data of the project obtained through the NeLCOS® energy storage calculator developed by ZH Storage are as follows: The total investment of the project is approximately 574.88 million yuan, with an installed power capacity of 45MW and an installed energy capacity of 225MWh. The annual discharge volume is 76.376 million kWh. The system is designed for a lifespan of 20 years, with an internal rate of return (IRR) of 10.07% and an estimated capital recovery period of 8.14 years.

The NeLCOS® energy storage calculator, independently developed and operated by ZH Energy, can provide accurate and fast generation of investment return rates for energy storage systems from the perspectives of levelized cost of energy storage, annual investment return rate, and energy storage configuration plans. It is available for free to energy storage customers and investors. For more information, visit the ZH Energy official website (www.zhenergy.net/) or scan the QR code to use it for free.

(https://nelcos.zhenergy.net/)

Product Series: