Still blindly investing in energy storage? This free tool helps you calculate every cent clearly to build a "digital moat" for your investments

Classification:Company News

- Author:ZH Energy

- Release time:Dec-04-2025

【 Summary 】Project investment is never just a matter of technical selection, but a complex calculation of finance and risks.

Energy storage project investment is never just a technical selection task—it’s a complex calculation of finance and risks. Faced with investments of tens of millions of yuan, 20-year operation cycles, fluctuating electricity price policies, and intricate subsidy rules, making impulsive decisions based solely on experience or single cases is like swimming blindly in the deep waters of uncertainty.

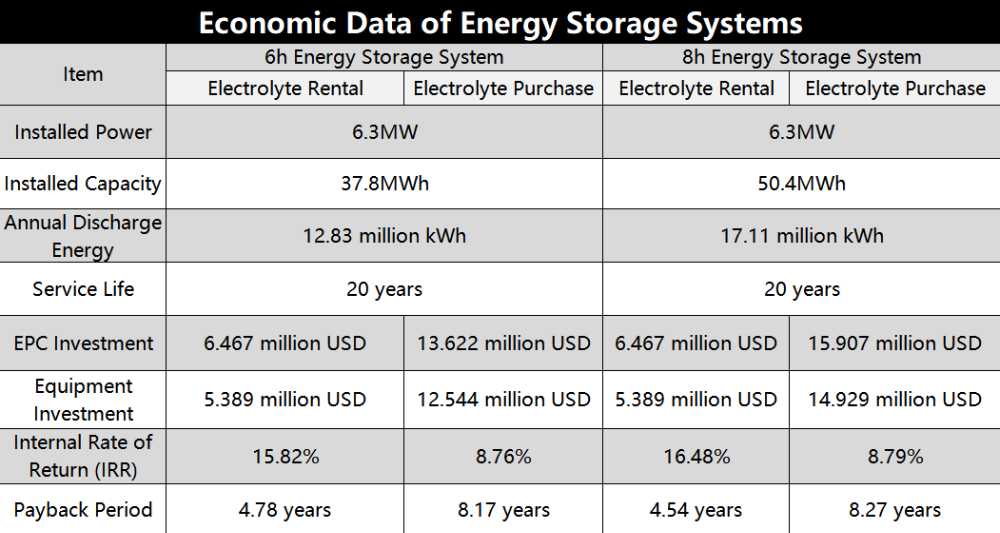

How to turn investment risks from "unknown" to "controllable"? The answer lies in precise, upfront economic feasibility calculation. From the practical application cases of the NeLCOS® calculator: whether it’s the 11.58% internal rate of return (IRR) calculated for a 2.5MW project in Shenzhen, or the impressive 15.82% IRR achieved by a 6.3MW project in Jiangsu under the electrolyte leasing model. Core data generated by the calculator (such as IRR and payback period) directly provides quantitative decision-making basis for project feasibility, shifting investment evaluation from "experience-based judgment" to "data-driven decision-making."

Schematic Diagram

When there are no benchmark cases to reference for project investment, the advantages of NeLCOS® become even more prominent. Because it is not just a "return calculator"—it’s your "risk filter" and "decision navigator":

Cut through policy complexity and quantify subsidy benefits

Local subsidy policies are complex (e.g., Shenzhen offers subsidies based on investment amount plus rewards based on discharge volume). How do these affect final returns? NeLCOS® can accurately calculate the actual boost of policy dividends to IRR and payback period based on specific policy parameters (such as subsidy ratio, upper limit, and duration), avoiding vague estimates of subsidy benefits.

Simulate diversified financing and optimize investment structure

Should self-owned capital account for 20% or 30%? How do loan term and interest rate affect cash flow? Previous application cases (e.g., a 5MW project in Henan, a 1.5MW project in Hunan) have shown IRR differences under different financing plans. NeLCOS® supports customized financing schemes, helping you find the "golden ratio" for optimal equity return rate.

Evaluate technical selection and clarify life-cycle costs

Should you lease or purchase electrolytes? This is not just an initial investment issue—it also relates to cash flow and final returns over 20 years (considering electrolyte residual value recovery). NeLCOS® allows one-click comparison of Life-Cycle Cost of Energy (LCOS) and IRR between the two models, making the economic logic of technical selection crystal clear.

Gain insights into market fluctuations and lock in safety margins

Electricity price spreads may narrow, and operation & maintenance (O&M) costs may rise in the future. NeLCOS® enables sensitivity analysis to simulate the elasticity of project returns when key variables (e.g., electricity price spread, O&M costs) change. This is equivalent to drawing a "risk map" for your investment in advance, clarifying the safety boundary for profitability.

Instead of waiting for a "perfect case" that fully matches your project conditions, it’s better to proactively create your own optimal plan.

ZH Energy NeLCOS® Energy Storage Calculator is exactly such a free, professional, and precise decision-making tool. From the perspectives of life-cycle cost of energy, annual investment return rate, and energy storage configuration scheme, it helps every energy storage investor and user build a solid "digital moat" for returns with data before investment.

Scan the QR code to use the free energy storage calculator: NeLCOS®